richmond county va business personal property tax

Start Your Homeowner Search Today. For Personal Property Tax Payments Feel free to contact the office should you have any questions 804-333-3555.

The Science Backed Mindset All Successful Realtors Share Video Video Growth Mindset Real Estate Career Mindset Strategies

Located in Central Virginia on Interstate 95 just north of Richmond Hanover County is the perfect place for businesses to innovate prosper and grow.

. Business Tangible Personal Property Tax Return2021 2pdf. On Tuesday the council voted. Ad Get In-Depth Property Tax Data In Minutes.

It is estimated that by freezing the rate the city will provide Richmonders more than 8 million in additional relief. For more information about locating or expanding your business in. You have the option to pay by credit card or electronic check.

Such As Deeds Liens Property Tax More. The median property tax in Richmond County Virginia is 673 per year for a home worth the median value of 148700. Search Richmond County Records Online - Results In Minutes.

Ad Pay Your Taxes Bill Online with doxo. Richmond County collects on average 045 of a propertys assessed fair market value as property tax. WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the payments.

Search Valuable Data On A Property. Richmond County has one of the lowest median property tax rates in the country with only two thousand nine of the 3143 counties collecting a. Ad Find Richmond County Online Property Taxes Info From 2022.

Depending on your vehicles value you may save up to 150 more because the city is freezing the rate. The forms may differ depending on the type of assets you are filing for whether it be tangible business personal property machinery and. Fax Numbers 804-768-8649 Administration Individual Personal Property Income Tax Tax Relief 804-796-3236 Business License Business Tangible Personal Property Hours.

There is a convenience fee for these transactions. If you have an issue or a question related to your personal property tax bill call RVA311 by dialing 311 locally visit. Virginia Personal Property Tax Returns Notices Bills.

Virginia businesses are required to fill out personal property return forms annually. You can make Personal Property and Real Estate Tax payments by phone. Business personal property taxes are calculated on a sliding scale and are depreciated each year the property is in use.

City Of Richmond Extends Personal Property Tax Deadline To August Wric Abc 8news

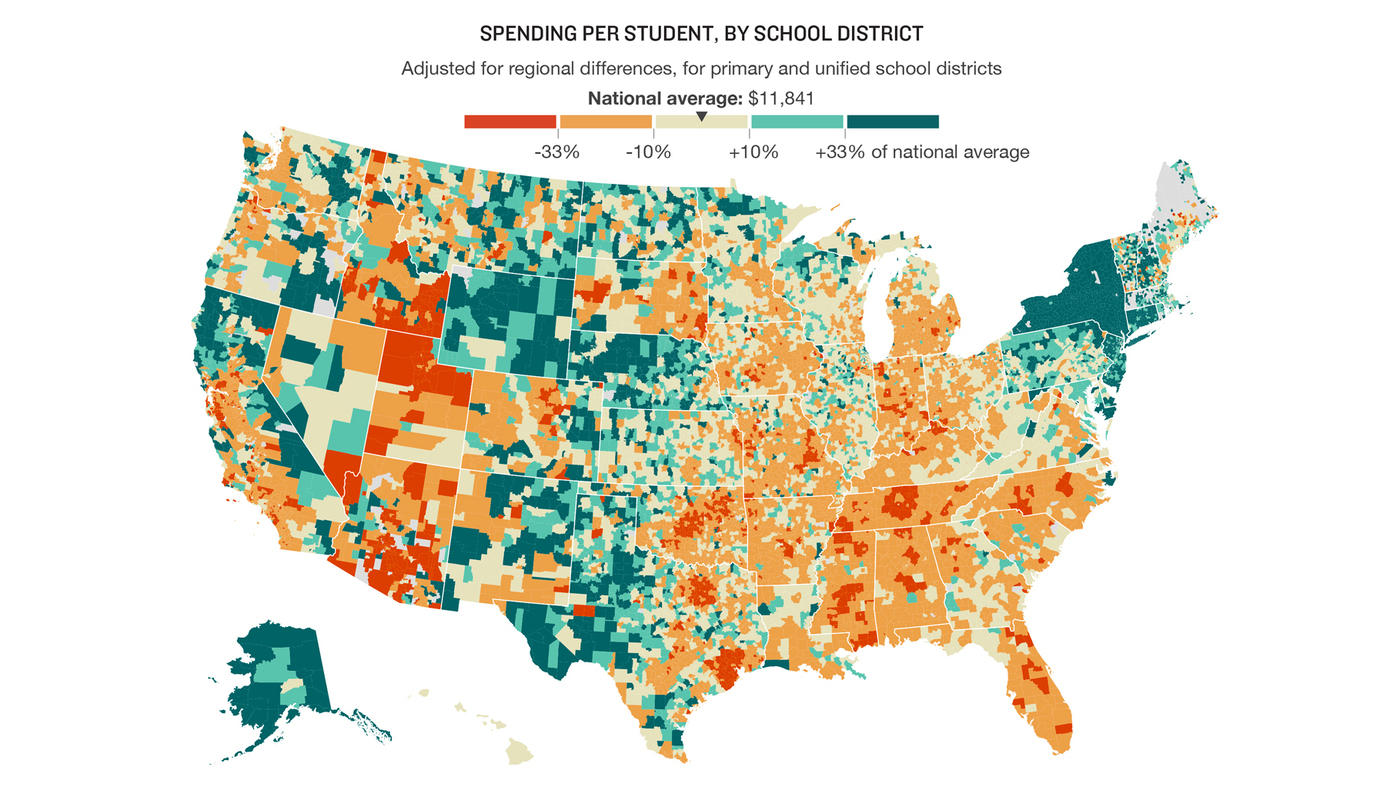

Population Wealth And Property Taxes The Impact On School Funding

All Loan Home Loan Personal Loan Loan Against Property Business Loan Easy Loan Rate Off Interest Home Home Loans Loan Interest Rates Buying First Home

Pay Online Chesterfield County Va

Chevy Chase Residents Gear Up For Fight Against Redevelopment Of Edge Property Chevy Chase Bethesda Fight

Getting A Tax Refund Consider Using It For Your Down Payment Forza Real Estate Buying First Home Money Saving Strategies Buying Your First Home

Many Left Frustrated As Personal Property Tax Bills Increase

How School Funding S Reliance On Property Taxes Fails Children Npr

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Population Wealth And Property Taxes The Impact On School Funding

Henrico County Announces Plans On Personal Property Tax Relief

/cloudfront-us-east-1.images.arcpublishing.com/gray/4ASPKZIKKZEKDBCSG3BYAZNXBM.jpg)

Richmond Personal Property Tax Payment Deadline Extended Until Aug 5

Henrico County Personal Property Tax Bills Due Friday Wric Abc 8news

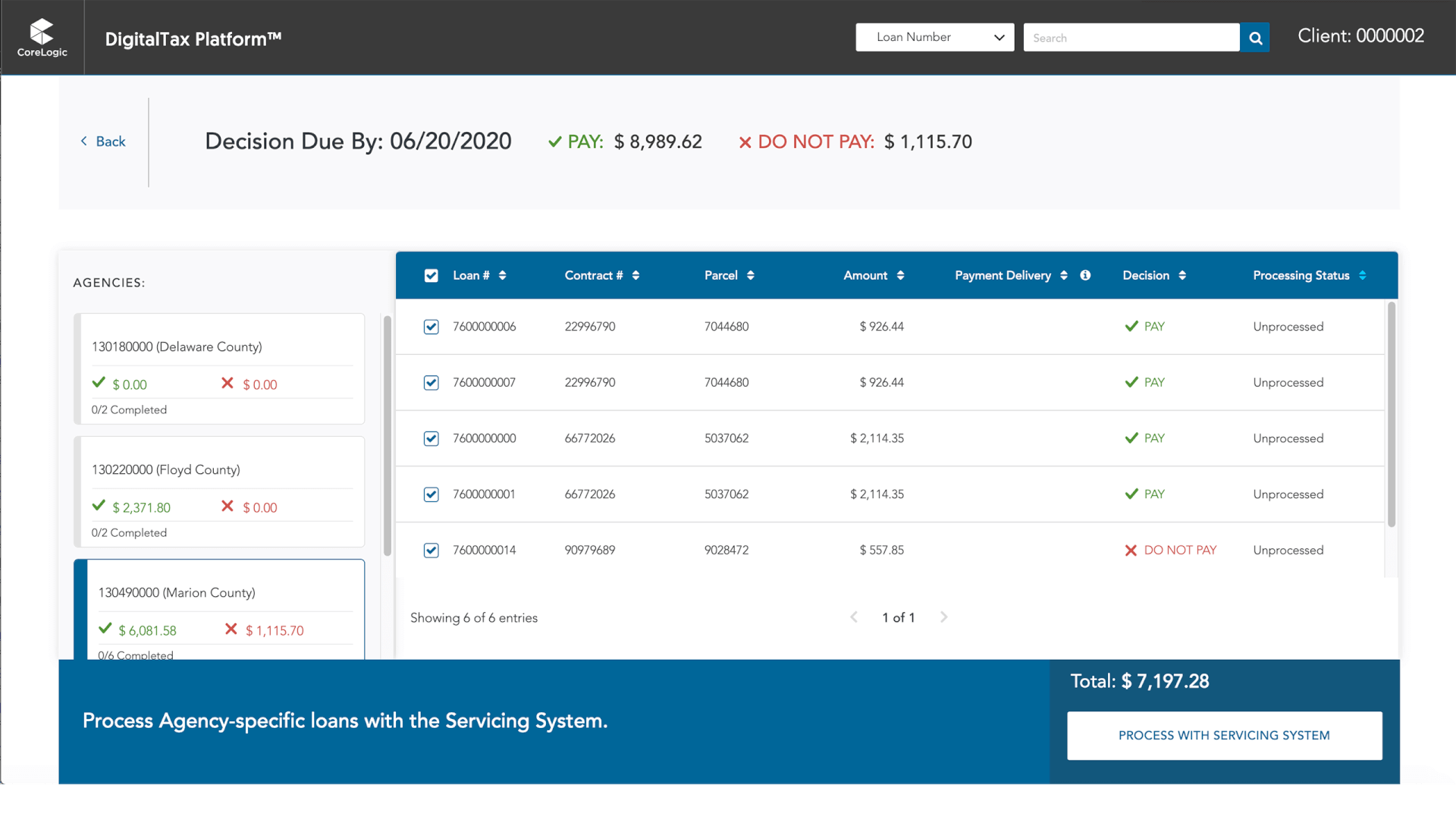

Residential Property Tax Solutions Corelogic

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Henrico County Announces Plans On Personal Property Tax Relief

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation